FIRE as a Force for Good

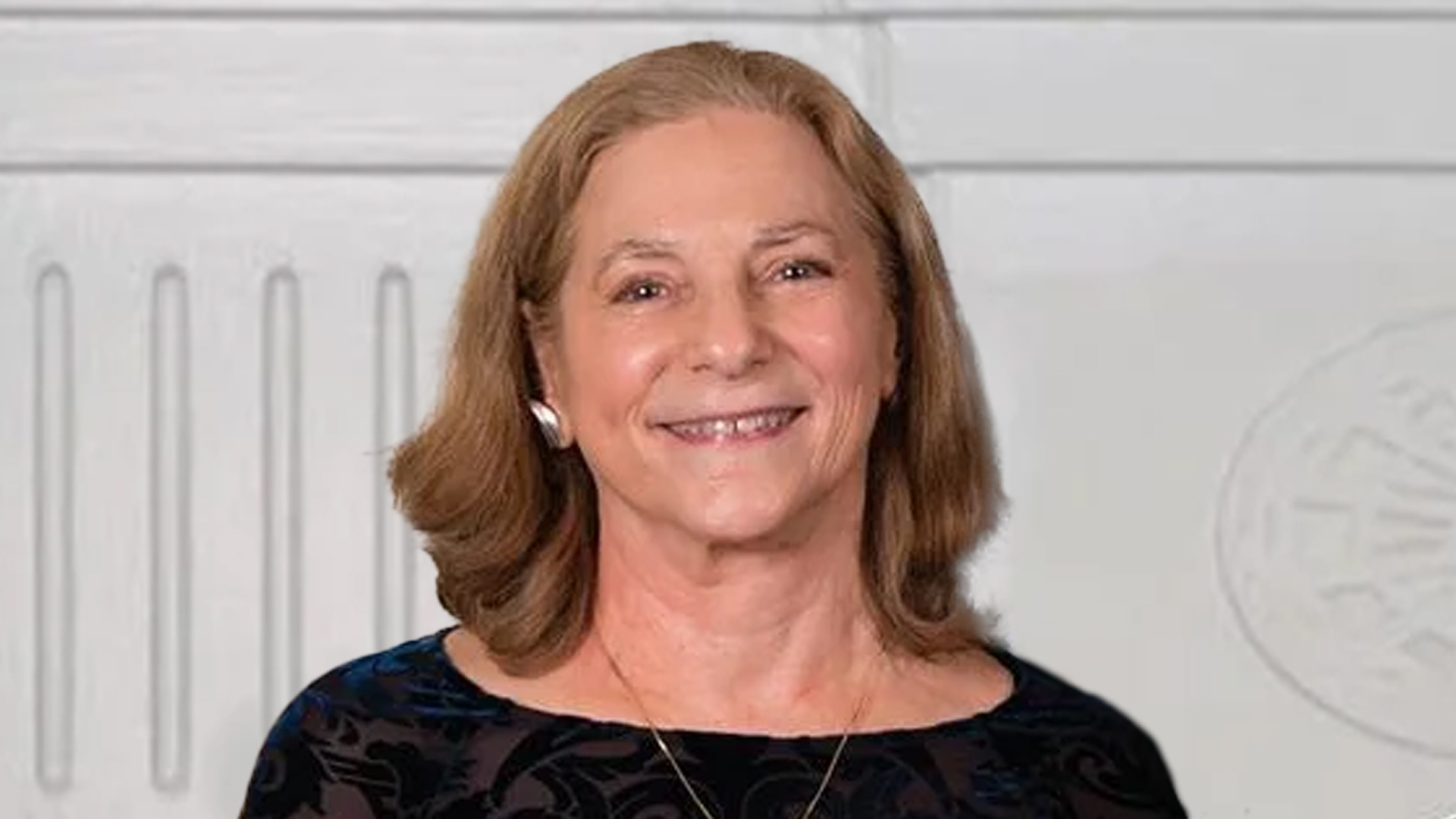

As a FIRE senior fellow and former president of the American Civil Liberties Union from 1991 to 2008, Nadine Strossen is a leading expert and frequent speaker/media commentator on constitutional law and civil liberties, who has testified before Congress on multiple occasions. If there's anyone who knows what it takes to defend our civil liberties, it's her.