Table of Contents

IRA Charitable Rollover Extended Through 2014

Last week President Obama signed a bill that extended the IRA charitable rollover until December 31, 2014. This tax break allows anyone 70.5 years or older to distribute up to $100,000 directly from their IRA to a qualified charity of their choice without paying income tax on the withdraw amount. This is an excellent tax incentive that allows you to support the causes most important to you while receiving substantial tax savings. If you would like to donate an IRA withdraw to FIRE, please contact your IRA administrator right away, or call or email Alisha Glennon, FIRE’s Vice President of Development, at 215-717-3473 or alisha@thefire.org. Don’t forget, this tax break expires in three days!

Recent Articles

Get the latest free speech news and analysis from FIRE.

The federal charges against Don Lemon raise serious concerns for press freedom

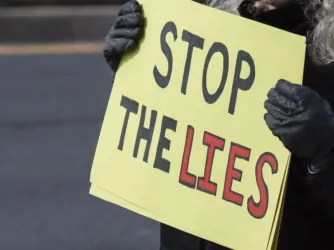

The American people fact-checked their government

California prohibits its teachers from talking about a student's gender identity to their parents. That raises First Amendment concerns.